A smart way to safeguard your money.

Information programmed into the chip is personalized for your

account and each transaction is unique, adding a new safeguard against fraud.

How do chip cards work?

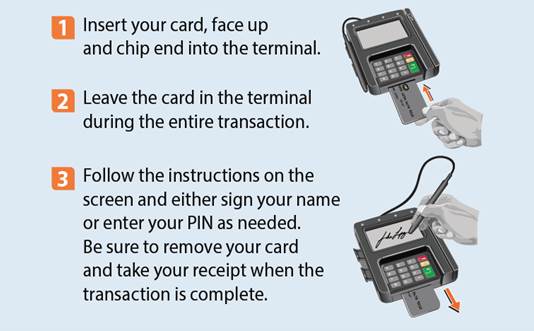

If a merchant is already using a chip-enabled terminal, paying is as easy as:

Using a chip card at an updated POS (point-of-sale) system will generate a code that is unique to that individual transaction—it can’t ever be used again.

If a merchant isn’t using a chip-enabled terminal yet, you’ll still be able to “swipe” your card to make your purchase, just as you do today.

At an ATM

The process is essentially the same as at a merchant. Insert your chip card into the terminal and follow the instructions on the screen. Depending on the type of ATM, you might be prompted to re-insert your card. Leave the card in the ATM until the transaction is complete and the card is released, and then remove your card and any cash you may have withdrawn. A PIN is needed to ATM transactions.

On the Internet or on the phone

Nothing has changed for transactions made Online or by telephone, so you’ll make payments just as you do today.

EMV does not solve online fraud.

EMV chip cards do not improve payment security for online purchases. You’ll still need to be cautious when making payments online. For example, you should always check for a secure connection (hint: the URL starts with https:// instead of http://) and be sure to trust your gut when entering your payment data—if it doesn’t feel right, move on to the next site.